Business Plans

All businesses and 501c3 organizations all need a business plan.

... Floyd Green CPA has served over 8,000 small businesses and nonprofits.

Business plans are used by businesses and nonprofits for multiple purposes, including:

- Obtaining capital from investors

- Applying for and soliciting grants and contributions

- Obtaining business loans

- Management strategic and operational planning

- Finding business expansion opportunities

- Estimating sales, expenses and other financial performance

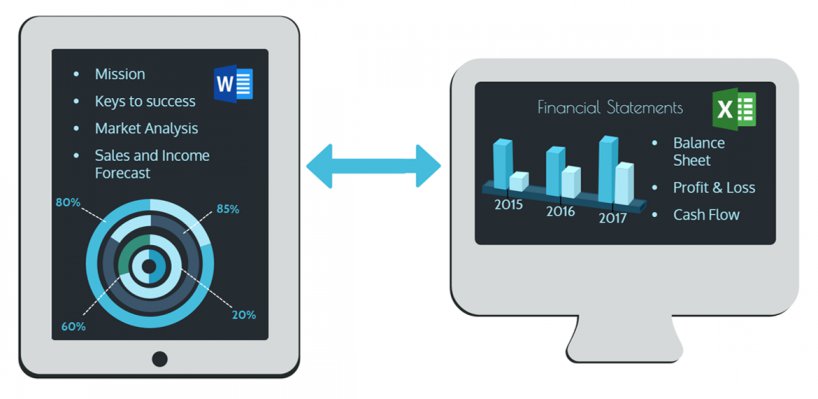

Our Comprehensive Business Plan

Our business plans are comprehensive and will meet the requirements of many interested parties. Some details of our business plans include:

- Plan for fundraising strategy

- Financial statements (profit & loss, balance sheet and cash flow statement)

- Financial statements are projected for 3 years

- Summary of start-up expenses

- Key elements for business or organization success

- Market analysis (needs of the market, competitiveness, threats and opportunities)

- Strategy, operations and business implementation

- Sales, revenue and other income forecasting

- Management Summary

- Industry or segment specific information

- Any additional information that your organization or business requires

Why use us to prepare your business plan?

- Many clients have successfully raised capital using our business plans.

- Our focus is small businesses, nonprofits and startups.

- We are a CPA firm, and thus include very detailed budgets and financial projects in your business plan

- We've prepared business plans for clients in many industries

Upon completion, you will receive a 30-page detailed business plan that reflects your business' or organization's potential (financial spreadsheets, charts and graphs included).

We prepare business plans for clients in all 50 states.